financial services

Financial Services handles the business and financial matters of the denomination including missionary support, investment in shared ministries and group long-term disability and family life insurance.

Financial focus

RETIREMENT

GuideStone® shares your mission and specializes in comprehensive retirement plans designed to accomplish your goals and prepare your employees for a successful retirement. We provide exceptional service, investment flexibility, and competitive pricing— all while striving to honor the Lord.

EMAIL GUIDESTONE >

or call 1-888-98-GUIDE

-

We work with you to identify plan goals and objectives to engage employees and drive participant outcomes.

-

We walk alongside you to determine the best investment framework to meet the needs of you and your participants, proudly featuring GuideStone Funds®.

-

Our technology delivers a simplified service and seamless recordkeeping experience.

-

Our 98% satisfaction rate is more than just a number — it’s our reputation. Our participants consistently call us trustworthy, helpful, and reliable, and we work every day to prove them right.

-

GuideStone offers various webinars on retirement.

Family Life Insurance

Term life insurance is designed to provide a financial safety net for your family during your most crucial income-earning years. Although it’s unpleasant to consider the possibilities, your family is counting on your help to maintain their standard of living after your death.

EMAIL OUR TEAM >

or call 1-260-747-2027

-

Coverage Amount

$50,000 coverage for employee $10,000 coverage for spouse $10,000 coverage for each eligible childBenefit Reduction at Age 65 (active employee)

Reduces to $33,000 for covered employee, continues at $10,000 for spouse and childrenMonthly Rate

$14, regardless of how many eligible members in the employee's family

MAKE A PAYMENT

IMPORTANT: BE SURE TO INCLUDE YOUR ID# (listed on your statement) in the "Order Notes" field and any other information you'd like to provide.

Long Term Disability

Protect your financial security during recovery, provide additional support if you become severely disabled, and help get you back to work as quickly as possible.

Disability insurance protects your paycheck by replacing a portion of your income during a disability. Long-term plans coordinate to maximize your benefit period.

EMAIL OUR TEAM >

or call 1-260-747-2027

-

Elimination period

90 daysDisability benefit

2/3 of monthly insured earningsMaximum monthly benefit

$10,000 per monthMinimum monthly benefit

Greater of 10% of gross disability payment or $100Monthly Premium

$0.0048 x monthly insured salary -

Anyone who is regularly scheduled to work at least 20 hours per week at a Missionary Church is eligible to enroll.

Enrollment

Download Enrollment form below

Return to Diana Boyer (dianaboyer@mcusa.org) using some secure online vehicle (e.g., Tresorit).

Employees must enroll through their MC employer because we only bill the church, not employees. Employees whose premiums are not included in their compensation package would be required to reimburse the church/employer through payroll deduction (or some other payment method).

2% INVESTMENT IN SHARED MINISTRIES

For the Missionary Church Investment in Shared Ministries, each church or church plant is responsible to pay 2% of donor income (general, missions, building, bequests, etc.) on a monthly basis in partnership with the national ministry. Churches are also responsible for a regional, district, and/or network assessment (% is varied from region to region). These required amounts are to be given regularly to the appropriate entity.

EMAIL OUR TEAM >

or call 1-260-747-2027

FAQ

-

The cost of being a denomination and of coordinating, organizing, and motivating the effort of local churches in national outreach is funded through this giving.

In addition to administrative concerns of the Fort Wayne, Indiana, office, funds in this account impact church planting, ethnic ministries, men’s and women’s programs, compassion and benevolent ministries, Bethel University, insurance, and many other areas. Local church support materials, Growing a Healthy Church workshops, and publications like Today’s Latest and Priority all depend on the Investment in Shared Ministries fund. In fact, excluding world missions, this account supports every aspect of denominational ministry and administration!

-

When the Missionary Church, Inc. was formed in 1969, it had a unified budget that cared for the total denominational administrative and overseas costs. But when the missionary share support system was developed, funds generated through shares were designated only for overseas ministry. The budget was no longer unified. As more and more money was committed to “shares,” the Investment in Shared Ministries area of the budget received less and less.

In 1987, churches were encouraged to set aside 2% of their income to what had always been part of the unified budget. By 1991, only 13% of denominational churches were supporting the fund at this level, and over 50% were not supporting it at all. To ensure funding, it was necessary to adopt the 2% investment, and participation has increased dramatically.

-

The 2% is calculated on total donor income (general, building, missions, bequests, etc.) received each month. The 2% is to be sent each month.

Income from subsidies and non-donor income such as day care centers, counseling centers, etc. is not to be included in the calculation.

-

Not only is the 2% giving an investment, it’s also a realistic goal for which churches should strive. Some give 2% while others are able to give as much as 10%. In isolated situations, a church may find it is impossible to invest the full 2%. If your church finds itself in this dilemma, please contact the denominational office to negotiate a lesser assessment goal.

-

In the early 1990s at a General Conference of the Missionary Church, Inc., the delegates representing all Missionary Churches made a decision to create a financial ministry commitment and responsibility as churches for the support of the national office. Thus the Investment in Shared Ministries (2%) program was instituted.

While this does not cover the total cost of national ministry, it covers about 74% of the US operation and ministry. Additional funds are raised to cover the remainder of the budget.

Obviously, such a large portion of total ministry support is key to the stability and effectiveness of the Missionary Church ministry effort; thus, the General Conference and General Oversight Council set guidelines for the Investment in Shared Ministry program.

None of the Investment in Shared Ministries fund supports World Partners, which raises its funding through missionary shares and other fundraising efforts.

-

As a part of the Missionary Church, each church contributes 2% of its income (“Investment in Shared Ministry”) for the national office operation and ministry. This is calculated on total donor income (general, building, missions, bequests, etc.). Income from subsidies and non-donor income such as day care centers, counseling centers, etc. is not to be included in the 2% calculation.

Churches are to send 2% of their total income on a monthly basis based on the total donor income from the previous month.

To reduce the external risk to the total budget of MCI, no single church’s giving will be budgeted for operations at a level higher than 2.5% of the MCI budget. When a church’s 2% contribution exceeds the 2.5% cap, MCI and the local church will partner in how to invest that surplus portion in ministry opportunities.

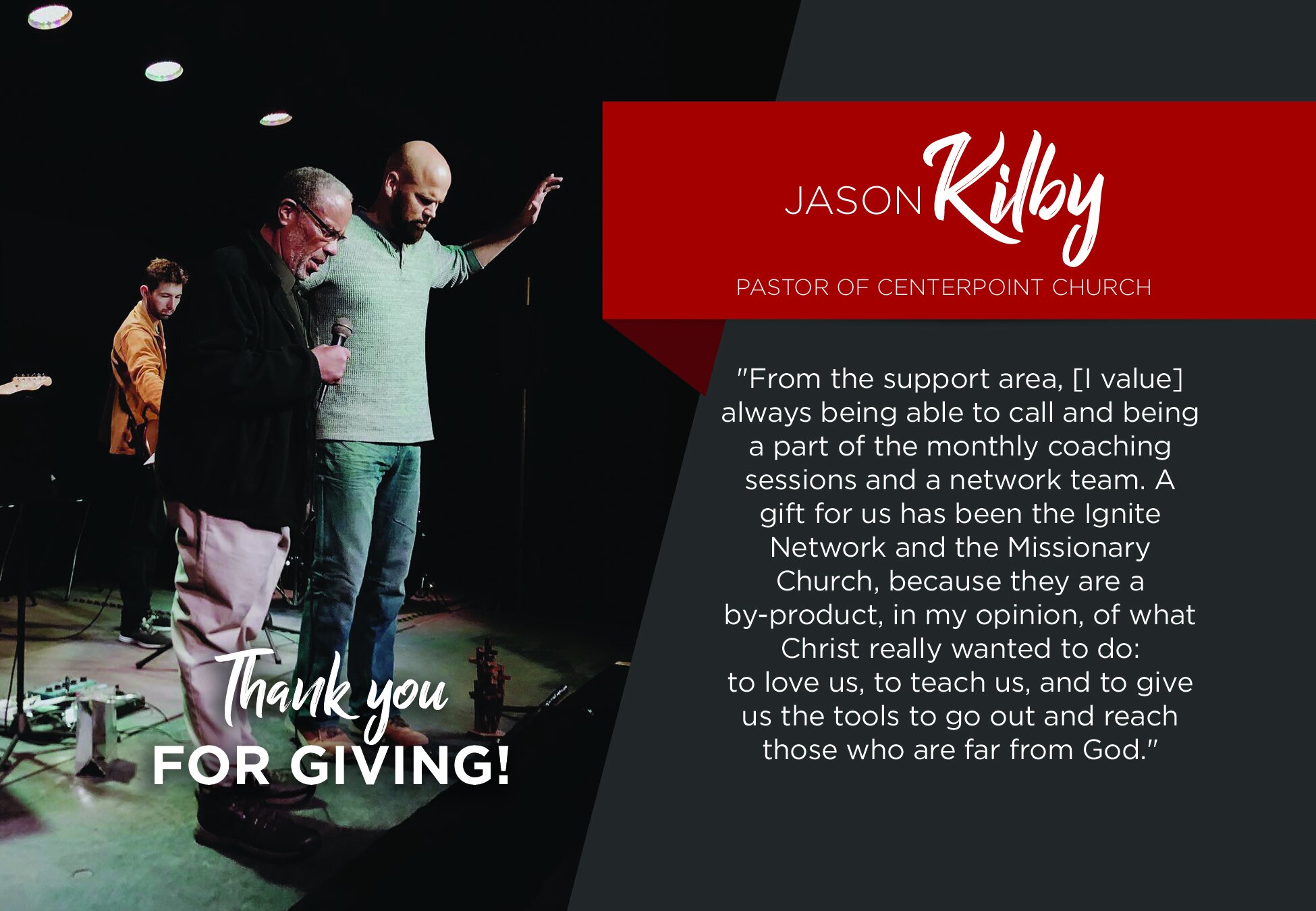

Your support makes a difference!

These stories are possible because you give.

checks & money orders

Missionary Church, Inc. is a 501(c)3 organization, and contributions are tax deductible.

Checks and money orders should be made payable to “Missionary Church, Inc.” Please designate the purpose and/or ministry objective of the check. If there is no designation, it will be assigned to general ministries.

Mail to:

Missionary Church, Inc.

PO Box 9127

Fort Wayne, IN 46899-9127

Electronic Fund Transfer (EFT)

An EFT is becoming a more routine part of our culture every day. It is regularly used for the payment of utility bills, insurance premiums, or loan obligations. Now the church is able to benefit from this procedure, and Gift Direct allows the Missionary Church to receive electronic transfers of financial gifts from the bank accounts of interested donors.

The Gift Direct program sets up an arrangement between the Missionary Church and your bank so that each month, on the same date, a predefined gift will be transferred from your checking or savings account to the Missionary Church. This program provides several advantages for both you as a donor and for the Missionary Church.

-

You no longer have to write a check, find the address, fill out the envelope, pay for stamps, etc. The transfer is automatic from your checking or savings account.

-

Your gift is transferred at the same time every month and does not require you to remember to make the gift.

-

Electronic fund transfer through Gift Direct is very safe, reliable, and accurate. There are no checks or receipts to be lost, stolen, or delayed in the mail.

-

Since your bank statement will show the transfer, the Missionary Church is saved the time and expense of printing and mailing receipts each month. An annual receipt will be sent for tax purposes.

Contact us

Missionary Church

c/o Financial Services

PO Box 9127

Fort Wayne, IN 46899-9127

Phone: (260) 747-2027

FAX: (260) 747-5331